The sales discounts contra revenue account records the discounts given to customers on sales made to them, normally a cash or settlement discount. The account is normally a debit balance and in use is offset against the revenue account which is normally a credit balance. Consequently the net balance of the two accounts shows the net value of the sales after discounts. Given that liabilities have a credit balance, ensure that all your contra liabilities accounts have debit balances.

In double entry bookkeeping terms, a contra revenue account or contra sales account refers to an account which is offset against a revenue account. Consider what would happen if you have sales on credit that you reasonably expect will budgeting principles of managerial accounting not be paid. In the example of Homes Inc. the percentage of customers defaulting on the account, and the amount defaulted, is estimable and probable. Past experience with uncollected bad debt has been, on average, 10% of credit sales.

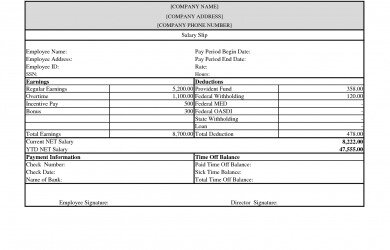

Trial Balance

Therefore, for these three, the debit balance actually represents a negative amount. Contra accounts exist when the account reported on the balance sheet needs to be reduced by a different account to show its true value. For example, GAAP accounting (or generally accepted accounting principles) requires fixed assets to be reported at cost on the balance sheet, but, over time, that value depreciates as the assets are used. The balance sheet will show a gross fixed assets value, a contra account value for accumulated depreciation, and a net value. All three values can be useful for investors depending on what they’re looking for. Contra revenue accounts show the reduced gross income because certain asset expenses give a business a net revenue outlook.

The contra liability account is less common than the contra asset account. An example of a contra liability account is the bond discount account, which offsets the bond payable account. A contra liability account is not classified as a liability, since it does not represent a future obligation.

- Let me give you the detailed steps on how to set up a contra account for accumulated depreciation.

- Last, for contra revenue accounts there are sales discounts, sales allowances, or sales returns.

- GAAP, the allowance for doubtful accounts represents management’s estimate of the percentage of “uncollectible” accounts receivable (i.e. the credit purchases from customers that are not expected to be paid).

- The Allowance for Doubtful Accounts is directly related to the asset account entitled Accounts Receivable.

- Examples of equity contra accounts are Owner Draws and Repurchased Treasury Stock Shares.

- A contra asset is paired with an asset account to reduce the value of the account without changing the historical value of the asset.

Moving forward, follow the steps below for the complete process of an account set up in the QuickBooks Desktop version. I’d love to show you the way and set up an account in QuickBooks Desktop, @khatfieldcpa. The product we get is written by computer people who have no clue what accounting is, further, there appears to be no input from CPA’s and Accountants. For more details about this one, I would recommend consulting your accountant and getting further assistance from them. This is to ensure that everything is accurate, and the reporting of your book is moving well. Emilie is a Certified Accountant and Banker with Master’s in Business and 15 years of experience in finance and accounting from large corporates and banks, as well as fast-growing start-ups.

Contra Asset Journal Entry Accounting

The purpose of the Accumulated Depreciation account is to track the reduction in the value of the asset while preserving the historical cost of the asset. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. When researching companies, the financial statement is a great place to start.

LIC throws up a challenge for FII bears. Will the contra bet pay off? – The Economic Times

LIC throws up a challenge for FII bears. Will the contra bet pay off?.

Posted: Thu, 03 Aug 2023 04:42:00 GMT [source]

Sale on account, which can also be known as a sale on credit or credit sales, refers to when businesses give a product over to a customer and customers do not have to pay until later. Credit sales are often risky because the chance of not collecting on the accounts receivable increases uncollectable percentages of credit sales, where the amount must be estimable and probable. Accounting for the contrary in a business will show the normal business account value, the attached contra account underneath it, with the net revenue the business experienced below. As mentioned, CA accounts are usually listed below their matching asset accounts, and the net values of those assets are written next to the contra accounts. This means that accounts receivables have a debit balance of $10,000, and the firm credits revenue for $10,000. A customer returned $100 worth of items, claiming them to be defective.

What is Contra Account?

A contra account is used to record adjustments and transactions that have an opposing impact to report the true value of a firm’s financial statements. Contra accounts are commonly found on general ledgers where all of a business’s accounts and transactions are organized on a master list. The contra account is used to report the correct assets while preserving the transactions and balance of the relating account.

In this way, a contra asset (credit) lowers the overall value of your accounts receivables (debit) on the balance sheet. This type of account could be called the allowance for doubtful accounts or bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible. The amount is reported on the balance sheet in the asset section immediately below accounts receivable.

The Contra Revenue Account

Sometimes, it is important to keep the original balance of the accounts and create the contra accounts to be able to calculate the net value of the account. Whenever the balance of an account needs to be reduced in a company’s ledger, it is not always applicable to credit the account if it is an asset or debit the account if it is a liability. Within equity, an example of a contra account is the treasury stock account; it is a deduction from equity, because it represents the amount paid by a corporation to buy back its stock. GAAP, the allowance for doubtful accounts represents management’s estimate of the percentage of “uncollectible” accounts receivable (i.e. the credit purchases from customers that are not expected to be paid). The net amount – i.e. the difference between the account balance post-adjustment of the contra account balance – represents the book value shown on the balance sheet.

Uber Announces Results for Second Quarter 2023 – InvestorsObserver

Uber Announces Results for Second Quarter 2023.

Posted: Tue, 01 Aug 2023 10:55:45 GMT [source]

If there’s an increase to allowance for uncollectible accounts, you record the same amount in the bad debt expense of your income statement. Similarly, accumulated depreciation accounts reduce the value of the fixed assets you report on your financial statements. Last, for contra revenue accounts there are sales discounts, sales allowances, or sales returns. These contra revenue accounts tend to have a debit balance and are used to calculate net sales. Contra equity is a general ledger account with a debit balance that reduces the normal credit balance of a standard equity account to present the net value of equity in a company’s financial statements. Examples of equity contra accounts are Owner Draws and Repurchased Treasury Stock Shares.

There are three commonly used contra revenue accounts, which are noted below. Key examples of contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Allowance for doubtful accounts reduce accounts receivable, while accumulated deprecation is used to reduce the value of a fixed asset. In order to balance the journal entry, a debit will be made to the bad debt expense for $4,000. Although the accounts receivable is not due in September, the company still has to report credit losses of $4,000 as bad debts expense in its income statement for the month. If accounts receivable is $40,000 and allowance for doubtful accounts is $4,000, the net book value reported on the balance sheet will be $36,000.

Although they all aim at reducing the balance of some type of account, it is useful to have some general foundational knowledge of the different types of accounts. Hence, the term valuation account represents all types of balance sheet accounts related to their corresponding balance sheet accounts. This helps the firms to evaluate the book value of their assets and liabilities. A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification. The use of a contra account allows a company to report the original amount and also report a reduction so that the net amount will also be reported. The net amount is often referred to as the carrying amount or perhaps the net realizable amount.

Examples of a contra revenue accounts include sales returns, sales discounts, and sales allowances. You debit the contra revenue accounts and credit the corresponding revenue accounts. For example, when you debit the balance in sales returns account, make sure that you offset the sales revenue account with a credit balance. A contra account offsets the balance in another, related account with which it is paired. Contra accounts appear in the financial statements directly below their paired accounts. Sometimes the balances in the two accounts are merged for presentation purposes, so that only a net amount is presented.

An estimate of bad debts is made to ensure the balance in the Accounts Receivable account represents the real value of the account. Allowance for Doubtful Accounts pairs with the Bad Debts Expense account when doing adjusting journal entries. If the balance in your allowance for doubtful accounts has a credit of $1,000 and your accounts receivable has $20,000 in normal debit balance, then the net value of the receivables is $19,000. A doubtful debts contra account allows for future write-offs of accounts receivable. Although you have not officially written off these debts yet, you show them to be a negative balance because you don’t believe the customer will pay you. The reason you show a contra asset on a balance sheet is so you can see the overall net balance of a particular asset and to give investors a more accurate look into your company’s financial activity.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

- We still have to manually set up and track on how much we depreciate a fixed asset into this account.

- In regards to your concern, the Accumulated Depreciation will not automatically set as a contra account in QBO.

- Be sure to enter the contra account on the opposite column of the account they’re offsetting.

- If a company offers an early payment discount (such as 1% or 2% of the invoice amount if it is paid within 10 days instead of the required 30 days) the amount of the discount is recorded in the contra revenue account Sales Discounts.

By keeping the original dollar amount intact in the original account and reducing the figure in a separate account, the financial information is more transparent for financial reporting purposes. For example, if a piece of heavy machinery is purchased for $10,000, that $10,000 figure is maintained on the general ledger even as the asset’s depreciation is recorded separately. Accounting is how we tell a story about an economic event or financial transaction, such as a purchase or a withdrawal of money, for example. Periodic financial statements report the impact of the story and are used by leaders of a firm or industry to analyze performance, plan, and respond. Let me give you the detailed steps on how to set up a contra account for accumulated depreciation.